Agents Apr 29, 2024 < 1 min read

Customer success story: Native Residential – The Almere

Since launching our latest deposit platform, flatfair Deposits, we’ve helped hundreds of agents and Build to Rent…

Deposit alternatives are becoming increasingly popular – in part due to the cost of living crisis. Tenants want more options when it comes to larger payments and landlords are seeking more protection.

As such, we receive lots of queries from agents about our No Deposit solution, so we wanted to answer as many of these as possible for you.

Answer : For tenants, we charge a small check-in fee of 1 week’s rent (+VAT), split evenly across the household. No Deposit is a one-off cost with no annual or hidden fees. This saves tenants on average £1000 on their upfront deposit costs.

No Deposit is completely free for landlords. So they benefit from up to 10 weeks protection on their property at no extra cost.

Offering our deposit alternative is also completely free for agents, and they generate additional revenue with each No Deposit plan selected.

Answer: Landlords can receive up to 10 weeks protection with flatfair No Deposit, which is double that of a traditional deposit.

This can be a combination of damages and/or rent arrears, with a cap of 5 weeks rent arrears.

Here is a real example from flatfair landlord Andy:

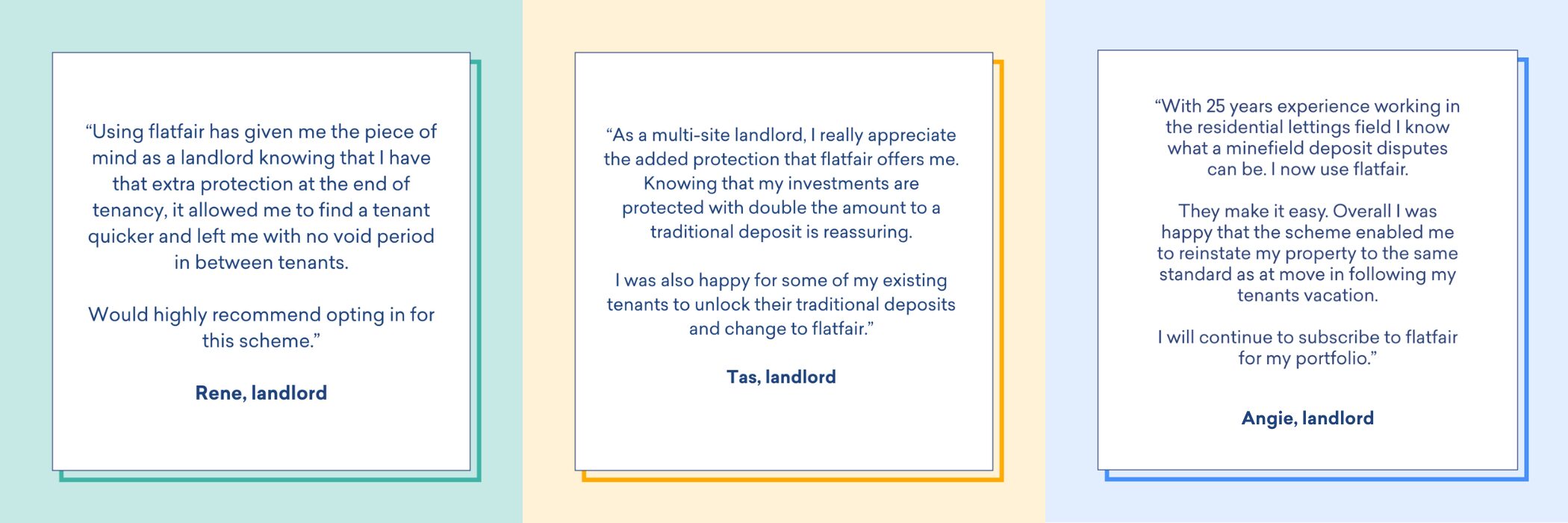

Answer: More than 20,000 landlords have benefitted from flatfair’s market-leading protection on their property. Here are just a few of their fantastic testimonials.

Answer: flatfair’s online platform facilitates a smooth end to end process for tenants to self-serve and choose their preferred deposit option, flatfair No Deposit or a traditional deposit.

Whichever option the tenants choose, flatfair manages the entire process for you. If tenants select a traditional deposit, we utilise Open Banking technology and integrate with all three UK deposit schemes to register traditional deposits for you swiftly and in accordance with legal timeframes to ensure compliance.

If tenants select flatfair No Deposit, all the digital paperwork and payments can be completed via our online platform.

We also have integrations with Goodlord and Reapit to remove duplication of tasks in the tenancy creation process.

Answer: With each No Deposit plan that your tenants select, you earn additional revenue for your business. This does not require any additional work from you as flatfair takes care of all the administration work.

Answer: At flatfair, we have strict eligibility criteria to ensure the best tenants are occupying your property. To be able to use flatfair, tenants and guarantors must be fully referenced and have their income verified by a third party referencing provider. Tenants also need the right to rent in the UK, which should be verified by their letting agent.

flatfair can’t accept tenants or guarantors who:

To make this process nice and easy, we integrate with Goodlord, HomeLet and Homeppl to fit your existing processes.

Answer: In the small amount of tenancies which result in disputes, our easy to use platform allows tenants and landlords to negotiate charges in order to find a swift and fair resolution.

If these charges can’t be agreed upon, you have the option of independent adjudication to fairly settle disputes, just as you would with a traditional deposit.

Is there a question we haven’t covered here? Use the form below to ask a question about our deposit solutions and our knowledgeable team will answer your query for you.

Since launching our latest deposit platform, flatfair Deposits, we’ve helped hundreds of agents and Build to Rent…

The escalating cost of living has rapidly and significantly impacted the UK lettings industry. Agents are working…